Nearly every B2B SaaS startup will eventually look to raise capital and/or cash out some or all of their equity. And even though we know this is true, most founders are so focused on establishing product viability, growing sales, and serving customers — as they should be — that they simply don’t have time to focus on building valuation strategies.

A lot of times the approach is “We’ll get to that when we need to, but now is not the time.” And while there’s no mistaking that a founder must be intently focused on the product and its sales funnel, paying attention to, and actively managing valuation and value drivers can give management a huge advantage when the time comes to seek funding.

Dedicating resources to educate your management team on the process, managing expectations, and staying on top of the value drivers in your company are key to understanding the how, what, and why of your valuation. The more educated you are about the things that drive value in your company, the better you’ll be able to manage the process when it comes. That education should be ongoing and constantly under review by you and your management team. Think of it like practice makes perfect.

The challenge of funding

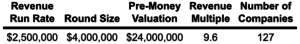

According to this Series A Valuation Report, by Blossom Street Ventures, that looked at 127 SaaS companies since May 2018, the “asks” from founders seeking funding are almost always viewed as too agressive. Those 127 companies asked for a median revenue multiple of 9.6x. Here’s the breakout:

The median revenue run rate was $2,500,000. They don’t tell us if this is all recurring user/licensing revenue or a mix of recurring license and non-recurring service revenue. As you scroll to the bottom of the Blossom Street Report, they summarize things quite interestingly (emphasis mine):

These asks are too aggressive. While this is like the barber telling you it’s time for a haircut (we’re VC after all), don’t be surprised or offended if a VC pushes back hard on the ask. It’s ok to make a strong ask as most VC won’t be turned off, but be ready to compromise. Also recognize that asking for a higher valuation will probably lengthen the time you’re out fundraising as it will take longer to find a VC that is forgiving on valuation.

As you can tell from this statement, getting funding is a challenge, to put it mildly. It’s also one of the most significant strategic events a business will undertake as they grow. Not only does a VC funding decision seek to maximize the return on equity, but owners are also deciding who to add as critical strategic partners to assist in guiding the future of their business.

If you’re dealing with experienced funding partners/VCs, they all want you to succeed. But make no mistake, they’re in business to make money, not leave money on the sidelines. Every single VC out there wants to maximize the return on their investments, while also ensuring the businesses they invest in are set up for future success. It’s a balance.

That means that VCs must balance initial valuations and corresponding funding offers against the probability of a company’s success if they push lower valuations. So, generally speaking, most VCs are motivated to value a company fairly, but they also have to ensure they aren’t overvaluing a business, and thereby jeopardizing future returns.

Intentional approach to business valuation

In making such a significant strategic decision, it’s imperative that any business with future plans to seek third party funding should start thinking about their valuation strategy immediately. If a business waits until the funding decision to start thinking about valuation, chances are high you’ll find yourself on defense instead of offense.

There’s an excellent white paper written by SaaS Capital that does a great job of laying out a fundamental approach to SaaS valuations. This is a perfect starting point for any B2B SaaS founder that wants to start thinking more intentionally about their valuation. Not only does it clearly explain valuation methodology, it also describes, in detail, five key value drivers:

- Growth and scale of revenue

- Addressable market size

- Revenue retention

- Gross margins

- Customer acquisition costs

One of the best things that any business can do is to diligently prepare for that moment when the founders are pitching to potential investors. And the best way to do that is to regularly track and report on all the financial metrics and value drivers you would ever expect to discuss during your management presentation. This can be accomplished through the preparation of a detailed financial analysis model, which can then serve as part of your business plan.

In addition to supporting internal valuations, a business plan gives management insights and information about a myriad of significant business details, such as:

- Cash flow

- Efficiency metrics

- Growth metrics

- Gross margins

- Detailed cost and revenue data

- SaaS metrics such as CAC, churn/retention, ARPU, and more

Conclusion

Maximizing valuation multiples is an ongoing exercise that management should be regularly and actively involved in, whether the company is currently seeking funding or not. In order to maximize returns when funding a business, you can never be over prepared. As with nearly any major business decision, putting a plan and executable strategy in place to prepare for a future funding event will give your business a huge advantage.

The key to a successful valuation in the future is to identify and build the valuation metrics into management reporting as soon as possible. In addition to establishing a foundation for your business plan, this educates management and creates focus on what matters most when it comes to the value of your company. It creates a knowledge flow that enables management to always be on the same page and to be working from a shared understanding of the business. When investors come calling, every member of the management team will be on the same page. That’s where value creation really comes into play.

About Left Mind

At Left Mind, we partner with B2B SaaS businesses to provide subscription-based virtual financial management services built specifically to serve this dynamic business model. This boutique approach offers SaaS businesses significant benefits over traditional consulting firms that serve multiple industries. By specializing in the SaaS industry, Left Mind is able to leverage their knowledge and insight to provide exceptional value to their customers. Contact us today for more information.